Monitoring both patient care and financial aspects is crucial. The integration of Revenue Cycle Management (RCM) is essential for ensuring the success and sustainability of a medical practice.

RCM is the central system that links patient health and financial performance. A streamlined RCM is key to maintaining both patient satisfaction and a thriving practice.

Effective RCM ensures that medical practices can focus on patient care without compromising financial stability, emphasizing the importance of a harmonious balance.

Running a medical practice means keeping a close eye on the health of two things: your patients and your bottom line. And if there’s one system that ties it all together, it’s Revenue Cycle Management, or RCM. I’ve seen firsthand how a well-run revenue cycle can make or break a practice.

Here’s everything I’ve learned over the years about making medical practice RCM—efficiently, compliantly, and profitably.

What is the RCM cycle in healthcare?

Revenue cycle management (RCM) is the end-to-end financial process used by healthcare providers to manage the administrative and clinical functions associated with patient service revenue. It starts before the patient walks in the door, with eligibility verification and pre-authorization, and doesn’t end until the final payment collection is completed. It's more than just electronic medical billing; it's how we make sure the care we provide gets reimbursed efficiently through an optimized rcm system.

Healthcare RCM zeroes in on how money flows in and out of the practice. It's about more than coding and claims—it's about understanding payer rules, reducing claim denials, and ensuring accurate documentation. Whether it’s a family medicine clinic or a multi-specialty group, healthcare RCM helps translate clinical services into revenue that keeps the lights on and the staff paid. Effective denial management and proactive claims processing are key parts of this cycle.

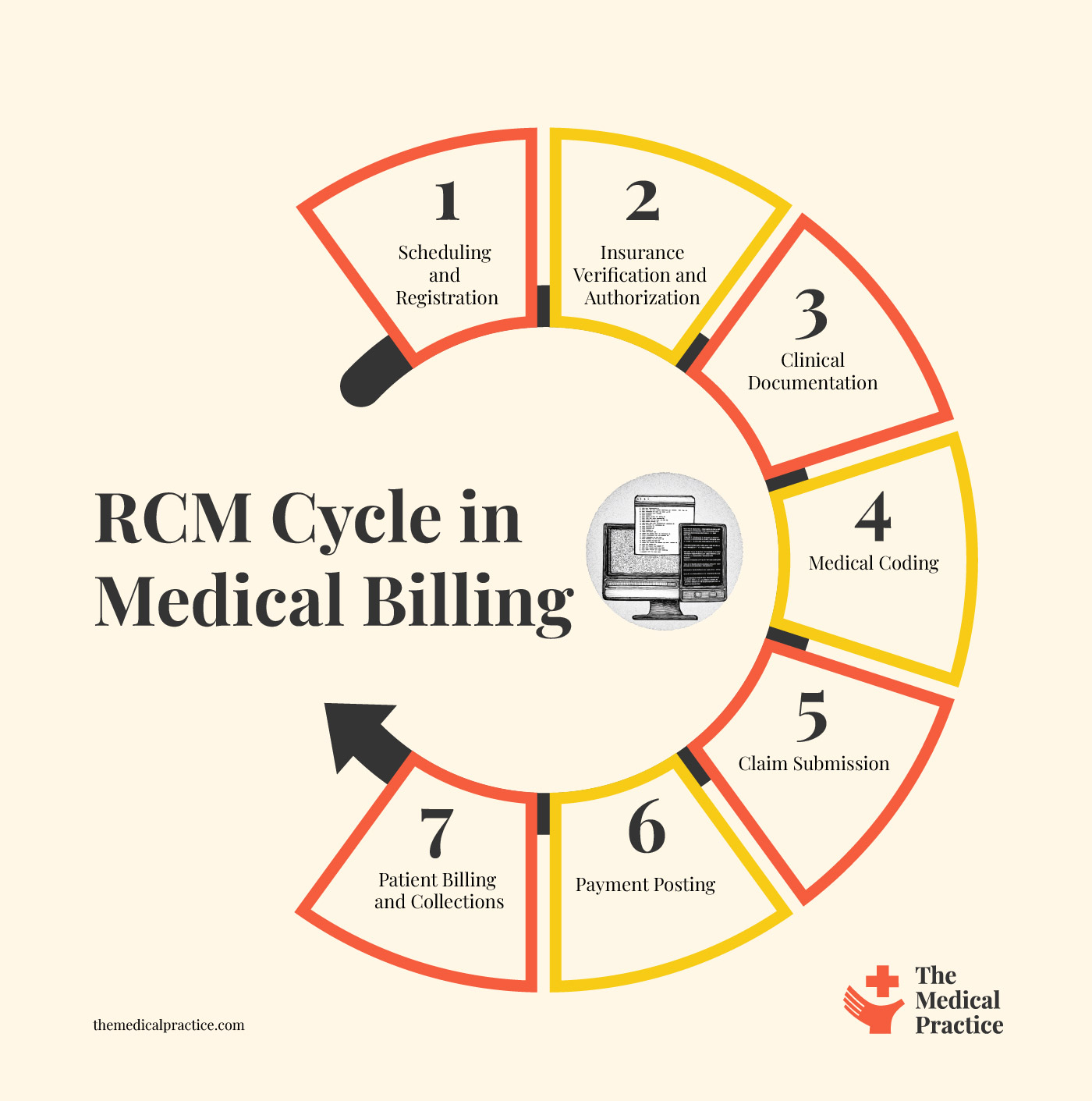

7 Step Revenue Cycle Management Process in Healthcare

The revenue cycle is the process that ensures the services we provide actually result in payment—and it touches nearly every department in the practice. Whether you’re running a solo office or a multi-specialty clinic, understanding each step of the revenue cycle is key to maintaining steady cash flow and avoiding costly mistakes.

Below, I’ve broken it down into the core stages of the RCM process in healthcare, along with the insights I’ve gained from years in the trenches.

1. Patient Scheduling and Registration

This is the front door of the revenue cycle, and in my experience, it's where most problems begin if you're not careful. When a patient calls to book an appointment, we gather their demographics, patient accounts, insurance details, and referral information (if applicable). Accuracy here sets the tone for the rest of the cycle. Incorrect data entry or missing policy numbers can lead to rejections and denied claims down the road, so we always double-check at this stage.

What you’ll need to succeed:

2. Insurance Verification and Authorization

Before the patient even walks in, our billing team performs eligibility verification. We confirm whether the service is covered, what the co-pay will be, and whether pre-authorization is required. Skipping this step—or doing it half-heartedly—can result in unpaid claims and unnecessary rejections. I’ve implemented automated eligibility verification checks in my practice, and it’s saved us hours each week while cutting down on coverage surprises.

What you’ll need to succeed:

- Pre-authorization Software

- Insurance verification tools

3. Clinical Documentation

After the patient is seen, the provider documents the visit in the EHR. This step needs to be both thorough and timely. Poor documentation doesn’t just affect care—it affects revenue. If the provider forgets to document a procedure, we can't bill for it. I stress to my team that "if it’s not documented, it didn’t happen"—and that’s not just a billing issue, it's a compliance one too. This is where charge capture becomes critical. Without accurate charge capture, revenue leaks are inevitable.

What you’ll need to succeed:

- EHR Software

- EMR Software

- Medical Records Courses

- Clinical Documentation Solutions

4. Medical Coding

Once documentation is complete, our coders assign the appropriate CPT, ICD-10, and HCPCS codes based on what was done and diagnosed. Accurate coding ensures we bill the correct amount and maintain billing compliance standards. Mistakes here can lead to underpayments, overpayments, or even audits. I’ve seen how ongoing coder training and periodic chart audits help catch issues early, and they play a key role in improving claims processing.

What you’ll need to succeed:

- A reliable Medical Billing & Coding Administrator

- Medical Billing & Coding Course

- Medical Coding Software

- Medical billing process flowchart

5. Claim Submission

Now it’s time to submit the claim to the insurance payer—electronically, in most cases. The system scrubs claims for errors before sending, but human oversight is still important. Rejected claims delay cash flow and frustrate staff. We aim for a 98% clean claim rate on first submission, which I monitor closely through monthly reporting. A strong process for submitting claims significantly reduces administrative burden.

What you’ll need to succeed:

- Claims Management Software

- Reliable claims processing tool

6. Payment Posting

When payments come in—whether from insurance companies or patients—they need to be accurately posted in the system. This includes applying adjustments, write-offs, and patient balances. If this step is done incorrectly, your financial reports will be off. I've trained my staff to double-check every payment, especially for underpaid claims that might need a follow-up. This is a critical component of payment processing and ensures the integrity of your RCM system.

What you’ll need to succeed:

7. Patient Billing and Collections

After insurance pays, patients are often responsible for the remainder. That means sending timely, easy-to-read statements and having a process for follow-ups. Payment collection isn’t fun, but it’s necessary. We’ve seen better results by offering online bill pay and payment plans. Clear communication and a proactive approach help avoid uncomfortable phone calls later. Establishing patient-friendly financial responsibility protocols is also a must for modern practices.

What you’ll need to succeed:

- Medical Billing Software

- Medical Billing Services (outsourcing)

- Debt Collections Services for Medical & Healthcare

- Transparent financial management & responsibility policies

RCM Analytics in Healthcare Practices: 5 Key Components

Data drives everything in modern RCM. I use dashboards and reports daily to track things like days in A/R, first-pass claim rate, and denial trends. The more data we collect—from payer responses to patient billing behaviors—the better we can tighten our processes. It’s how we identify leaks in the revenue pipeline and patch them before they grow.

There’s a simple, repeatable process I follow when applying analytics to revenue cycle management. Here’s how it breaks down:

1. Data Collection for Healthcare RCM

We gather data from multiple sources—EHRs, billing software, clearinghouses, and patient payment systems. The goal is to get a full picture of what's happening at every stage of the cycle.

2. Data Cleaning for Healthcare RCM

This step is all about accuracy. We check for duplicates, errors, or missing values to make sure the data we're analyzing is reliable. Clean data means better decisions.

3. Data Analysis for Healthcare RCM

Now we dig into the numbers. We look for trends, problem areas, and performance gaps. For example, a sudden spike in denials or a drop in clean claim rates tells us where to focus.

4. Action Planning for Healthcare RCM

Based on what the data reveals, we create a plan. That could mean retraining staff, fixing a workflow bottleneck, or adjusting payer-specific processes.

5. Implementation and Monitoring for Healthcare RCM

We roll out the changes, then keep an eye on the same metrics to measure improvement. This closes the loop and helps us continuously fine-tune our processes.

Common Revenue Cycle Metrics You Should Track

I rely on a core set of KPI metrics for medical billing to track the health of our revenue cycle. These include:

- Days in Accounts Receivable (A/R): This tells me how long it takes to get paid. Lower is better.

- Clean Claim Rate: The percentage of claims accepted on the first try—an early sign of how well we’re doing on the front end.

- Denial Rate: How many claims are being rejected and why.

- Net Collection Rate: This shows how much of the collectible revenue we’re actually collecting.

- Bad Debt Rate: What portion of our charges ends up written off due to non-payment.

These aren’t just numbers to report on—they’re tools I use to run the business smarter and catch issues early.

Benefits of Revenue Cycle Management (RCM) in Medical Practices

Implementing effective RCM processes can significantly enhance a medical practice's financial performance, operational efficiency, and patient satisfaction. Below are key benefits, each reinforced with data-driven insights:

Improved Cash Flow and Financial Stability

Efficient RCM practices lead to faster reimbursements and more predictable revenue streams. For instance, practices that outsource RCM services can achieve clean claim rates as high as 99%, minimizing delays and maximizing reimbursements. Additionally, a well-structured RCM solution ensures that payments are collected faster, errors are minimized, and cash flow remains steady.

Fewer Billing Errors and Denials

Proper RCM reduces billing errors, leading to fewer claim denials. Notably, front-end errors cause 44% of denials, and missing prior authorizations lead to 22% of unrecoverable claims. Implementing robust RCM processes can help address these issues, reducing denial rates by up to 35% within six months.

Increased Patient Satisfaction

Transparent and accurate billing processes enhance patient trust and satisfaction. High patient satisfaction rates can result in faster payments and better patient-provider communication. Moreover, aligning RCM approaches with patient feedback—such as offering easier methods for paying bills and clearer explanations—can significantly improve the patient experience.

Better Use of Staff Time

Automating repetitive RCM tasks—like eligibility checks or payment posting—frees up staff to focus on higher-value work in the medical billing pipeline. This shift from manual processes to automation improves staff productivity and reduces burnout. Additionally, outsourcing RCM services can increase the quality of claims management, significantly impacting cash flow

Stronger Compliance and Reduced Risk

With all the regulations in healthcare, a strong RCM process helps keep your practice compliant. Implementing compliance-focused processes has been shown to lower denial rates by up to 30%, directly improving cash flow. Regular internal audits and ongoing staff training are essential to a robust revenue cycle management compliance program.

Medical Billing RCM FAQs

Here are some questions people also ask me about medical billing, medical practice RCM, and revenue cycle management more generally:

Why is insurance and financial data critical to medical billing success?

Accurate handling of insurance coverage, insurance claims, and insurance information is crucial to prevent claim denials and reduce patient out-of-pocket surprises.

Verifying deductibles and clarifying financial responsibility upfront helps maintain transparency and trust. Additionally, monitoring the financial health of your practice and aiming for consistent profitability ensures sustainability.

These elements form the foundation of effective medical billing strategies that align with payer policies and optimize cash flow.

What role do patients play in the billing and RCM lifecycle?

Patients are central to the RCM lifecycle. Accurate patient registration at the start is vital for downstream processes, including checking patient eligibility, updating patient information, and promoting active patient engagement.

When practices involve patients early—educating them on their benefits and costs—they reduce confusion and improve satisfaction. Efficient communication with patients also leads to more reliable data, helping avoid billing errors and facilitating timely payments, ultimately supporting better patient care.

How does clinical data impact billing accuracy?

Inaccurate clinical documentation—such as errors in diagnoses or coding errors—can lead to claim denials or underpayments.

Proper use of electronic health records (EHRs) ensures that provider notes are accurately translated into billing codes, which supports compliance and reimbursement. Good documentation practices not only streamline communication between clinical and billing teams but also safeguard against audits and legal risks.

What tools help streamline RCM workflows?

Tools that support optimization, integration, and overall streamline efforts are key to reducing manual work in medical billing. Integrated software systems connect front-end and back-end processes—like registration, eligibility checks, and billing—so that teams work from a single source of truth.

Automating repetitive tasks and enabling data sharing across platforms minimizes delays and errors, helping practices maximize revenue and operate more efficiently.

How do healthcare organizations adapt RCM strategies across the industry?

Across the healthcare industry, organizations of all sizes—from solo practices to large healthcare organizations—must tailor their RCM strategies to fit their workflows, payer mix, and patient population.

This involves refining processes for delivering medical services, training staff on current regulations, and adopting scalable billing solutions. Adapting to industry trends ensures practices remain competitive, compliant, and financially sound.

What Next?

To stay updated on the latest trends, best practices, and solutions related to your medical practice, subscribe to The Medical Practice newsletter.